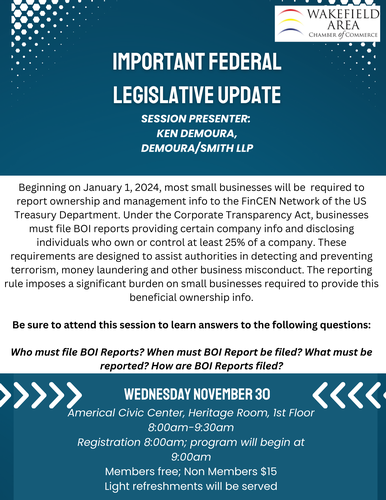

IMPORTANT FEDERAL LEGISLATIVE UPDATE

Beginning on January 1, 2024, most small businesses will be required to report ownership and management info to the FinCEN Network of the US Treasury Dept. Under the Corporate Transparency Act, businesses must file BOI reports providing certain company info and disclosing individuals who own or control at least 25% of a company. These requirements are designed to assist authorities in detecting and preventing terrorism, money laundering and other business misconduct. This reporting rule imposes a significant burden on small businesses required to provide this beneficial ownership info.

Be sure to attend this session to learn the answers to the following questions:

Who must file BOI reports? When must BOI reports be filed? What must be reported? How are BOI reports filed?

Date and Time

Thursday Nov 30, 2023

8:00 AM - 9:30 AM EST

Thursday, November 30, 2024

8:00am-9:30am

Location

Americal Civic Center, Heritage Room (1st Floor)

476 Main St.

Wakefield, MA. 01880

Fees/Admission

Members- Free

Non Members- $15